Introduction: In a momentous turn of events for the cryptocurrency world, Bitcoin has once again captured the spotlight by smashing through its previous all-time high (ATH). Surging past previous records, Bitcoin’s latest ascent marks a historic milestone in its journey from obscure experiment to mainstream phenomenon. As investors and enthusiasts celebrate this remarkable achievement, it’s worth delving into the factors driving Bitcoin’s resurgence and the broader implications for the cryptocurrency market.

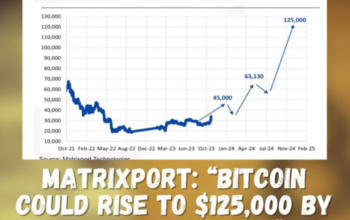

Breaking Records: Bitcoin’s Spectacular Rise Bitcoin’s latest rally has been nothing short of spectacular, with the cryptocurrency breaking through its previous ATH and reaching unprecedented price levels. Surpassing its previous peak of nearly $65,000 reached in April 2021, Bitcoin’s new ATH has reignited excitement and optimism among its supporters while attracting renewed attention from investors, institutions, and the media.

Factors Fueling Bitcoin’s Surge: Several key factors have contributed to Bitcoin’s recent surge to new ATH:

- Institutional Adoption: Institutional interest in Bitcoin has surged in recent years, with major corporations, asset managers, and financial institutions adding Bitcoin to their balance sheets as a hedge against inflation and currency debasement. High-profile endorsements from the likes of Tesla, MicroStrategy, and Square have bolstered Bitcoin’s legitimacy and attracted institutional capital into the market.

- Macro-Economic Conditions: Amidst unprecedented monetary stimulus measures by central banks, growing concerns about inflation, and geopolitical uncertainty, Bitcoin has emerged as a preferred store of value for investors seeking refuge from traditional financial markets. As faith in fiat currencies wanes, Bitcoin’s finite supply and decentralized nature offer a compelling alternative.

- Supply-Side Dynamics: Bitcoin’s scarcity, with a maximum supply cap of 21 million coins, coupled with its halving mechanism, which reduces the rate of new supply issuance approximately every four years, creates a deflationary supply schedule that incentivizes long-term holding and price appreciation. As the rate of new Bitcoin issuance slows over time, supply constraints drive prices higher, particularly during periods of increased demand.

- Growing Adoption and Awareness: Bitcoin’s expanding ecosystem of users, merchants, and service providers, coupled with increasing mainstream media coverage and educational efforts, has contributed to growing awareness and acceptance of Bitcoin as a legitimate asset class. As more people recognize Bitcoin’s utility as a medium of exchange, store of value, and hedge against systemic risk, demand for Bitcoin continues to grow.

The Implications of Bitcoin’s New ATH: Bitcoin’s latest ATH carries significant implications for the broader cryptocurrency market and the future of finance:

- Market Confidence and Sentiment: Bitcoin’s ability to surpass its previous ATH demonstrates resilience and confidence in the cryptocurrency’s long-term viability and value proposition. The achievement of new price milestones can have a positive feedback loop, reinforcing bullish sentiment and attracting new participants into the market.

- Price Discovery and Volatility: While Bitcoin’s surge to new ATHs is cause for celebration among investors, it also underscores the inherent volatility and unpredictability of the cryptocurrency market. Price discovery in nascent markets like Bitcoin can be highly speculative, leading to rapid price fluctuations and increased risk for investors.

- Regulatory Scrutiny: As Bitcoin’s market capitalization grows and its influence expands, regulators and policymakers are paying closer attention to the cryptocurrency’s impact on financial stability, consumer protection, and monetary policy. Heightened regulatory scrutiny could pose challenges for Bitcoin’s continued growth and adoption, particularly if regulatory measures stifle innovation or restrict market access.

Conclusion: Bitcoin’s surge to a new all-time high represents a significant milestone in the evolution of cryptocurrency and a testament to its enduring appeal as a disruptive force in finance. As Bitcoin continues to break barriers and defy expectations, its journey from fringe curiosity to global phenomenon accelerates, reshaping the way we perceive and interact with money in the digital age. While challenges and uncertainties remain, Bitcoin’s resilience and adaptability suggest that its ascent is far from over, with the potential to revolutionize the global financial system in ways we have yet to imagine.